INSPIRATIONAL BRAND CATEGORY

Sai Gon Thuong Tin Commercial Joint Stock Bank (Sacombank)

Information about the Company & Brand

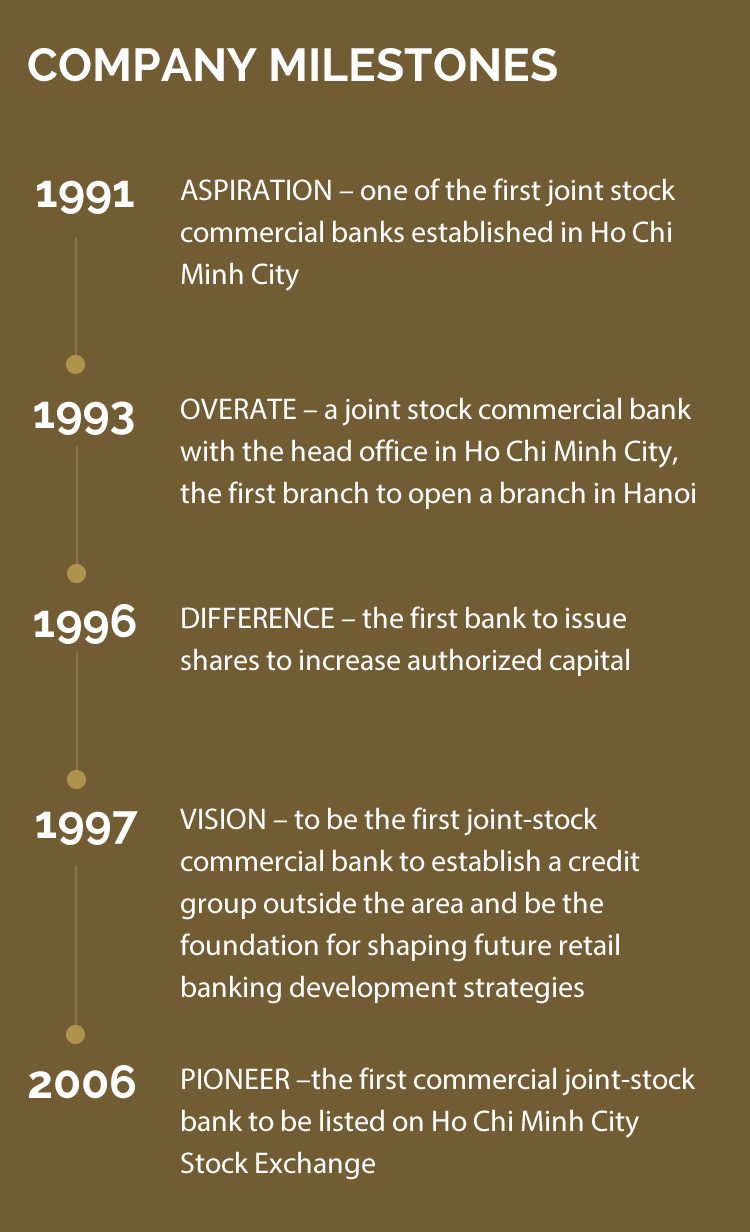

Sacombank is one of the first Joint Stock Commercial Banks established in Ho Chi Minh City with initial charter capital of VND3 billion. Throughout the pandemic, Sacombank has firmly applied its achievements, the quintessence of technology to flexibly implement many policies to fully ensure the interests of each shareholder, partner, customer, and investor, therefore reaching the milestone of serving up to 10 million customers row.

In 2022, Sacombank is confident to continue to maintain its position, keeping the trust of shareholders, partners, customers, and investors, and committed to writing more impressive numbers in the restructuring journey.

Brand Elements

Amid many difficulties caused by the Covid-19 pandemic, the 10 million customer expansion campaign launched by Sacombank at the beginning of 2021 has reached the finish line one month ahead of schedule.

Technology is the basis for Sacombank to launch a campaign of 10 million customers with 2 main spears – promotions and boosting total sales on channels, especially online channels.

The campaign was deployed wildly at all transaction points, promoting through online marketing channels, and spreading positive energy to the community in the form of posting and live streams.

Sacombank combined forces with large enterprises and prestigious economic organizations such as Vietnam Airlines, and Bamboo Airways, and connected with digital platforms such as Tiki, Zalo and a system of 2000 schools at all levels, and international remittance partners to create a financial ecosystem.

Sacombank constantly invested in payment services through online channels such as Internet Banking, Moblie Banking, and Sacombank Pay on a first-class, safe and secure technology platform.

Sacombank is one of the first Joint Stock Commercial Banks established in Ho Chi Minh City with initial charter capital of VND3 billion. Throughout the pandemic, Sacombank has firmly applied its achievements, the quintessence of technology to flexibly implement many policies to fully ensure the interests of each shareholder, partner, customer, and investor, therefore reaching the milestone of serving up to 10 million customers row.

In 2022, Sacombank is confident to continue to maintain its position, keeping the trust of shareholders, partners, customers, and investors, and committed to writing more impressive numbers in the restructuring journey.

Brand Elements

Amid many difficulties caused by the Covid-19 pandemic, the 10 million customer expansion campaign launched by Sacombank at the beginning of 2021 has reached the finish line one month ahead of schedule.

Technology is the basis for Sacombank to launch a campaign of 10 million customers with 2 main spears – promotions and boosting total sales on channels, especially online channels.

The campaign was deployed wildly at all transaction points, promoting through online marketing channels, and spreading positive energy to the community in the form of posting and live streams.

Sacombank combined forces with large enterprises and prestigious economic organizations such as Vietnam Airlines, and Bamboo Airways, and connected with digital platforms such as Tiki, Zalo and a system of 2000 schools at all levels, and international remittance partners to create a financial ecosystem.

Sacombank constantly invested in payment services through online channels such as Internet Banking, Moblie Banking, and Sacombank Pay on a first-class, safe and secure technology platform.

"Growing together": with shareholders to accompany the Bank, the Bank to accompany the customers, the Bank to accompany the society.

Inspiring Identity

With 30 years of establishment and development, Sacombank has always been consistent with its sustainable development-oriented governance model. This is a guideline to help the Bank firmly cope with difficulties and challenges to spread positive beliefs and values to the community and society.

In 2021, Sacombank continues to meet all the criteria in the Corporate Sustainability Index (CSI) and was honored as the Top 3 most favorite listed companies by investors in 2021 in the Program of Average Business. Selected Listed Company with Best Investor Relations in 2021 (IR Awards 2021) conducted by Vietstock in collaboration with Finance and Life newspaper (Fili.vn).

The foundation for its development lies in its wide customer base and the trust of nearly 200,000 corporate customers over the past 30 years. Sacombank has always understood and maintained its relationship with corporate customers by constantly improving and diversifying products and services to bring customers the most optimal experience.

Achievements & Impact

By the end of November 2021, the 10 million customer campaign has reached its target with a growth of 143% compared to 2020. With the pioneering factor in technology, Sacombank has continuously deployed large campaigns to attract clients. Typically, "Brilliant Summer Opening – Opening Million Deals" with 4 incentive programs, dialing, and millions of valuable prizes for all individual and corporate customers using services at the counters and transactions.

In the past two years, Sacombank's online transaction channels have proven their advantage in supporting customers to make transactions, helping to limit contact and save time and money.

Future Direction

Vietnam's economy and financial market are expected to receive both opportunities and challenges after Covid-19. So far, Sacombank has transformed strongly and is accelerating back to track. It completes the Restructuring Project; effectively exploits Capital, increasing the efficiency of using Assets; expands business scale, increasing operational efficiency; enhances brand value, and develops customer trust; increases customer experience and satisfaction; improves management, improves operating methods; standardizes operations, and strengthens risk management; strengthens the foundation of Digital Transformation Strategy; optimizes human resource policies, promoting labor productivity; connects corporate culture to operating strategy.

To develop the customer segment in small and medium enterprises (SMEs), Sacombank increases engagement and takes advantage of opportunities to develop an existing large corporate customer base. To develop large corporate customer segments, Sacombank develops the orientation of risk management.

With 30 years of establishment and development, Sacombank has always been consistent with its sustainable development-oriented governance model. This is a guideline to help the Bank firmly cope with difficulties and challenges to spread positive beliefs and values to the community and society.

In 2021, Sacombank continues to meet all the criteria in the Corporate Sustainability Index (CSI) and was honored as the Top 3 most favorite listed companies by investors in 2021 in the Program of Average Business. Selected Listed Company with Best Investor Relations in 2021 (IR Awards 2021) conducted by Vietstock in collaboration with Finance and Life newspaper (Fili.vn).

The foundation for its development lies in its wide customer base and the trust of nearly 200,000 corporate customers over the past 30 years. Sacombank has always understood and maintained its relationship with corporate customers by constantly improving and diversifying products and services to bring customers the most optimal experience.

Achievements & Impact

By the end of November 2021, the 10 million customer campaign has reached its target with a growth of 143% compared to 2020. With the pioneering factor in technology, Sacombank has continuously deployed large campaigns to attract clients. Typically, "Brilliant Summer Opening – Opening Million Deals" with 4 incentive programs, dialing, and millions of valuable prizes for all individual and corporate customers using services at the counters and transactions.

In the past two years, Sacombank's online transaction channels have proven their advantage in supporting customers to make transactions, helping to limit contact and save time and money.

Future Direction

Vietnam's economy and financial market are expected to receive both opportunities and challenges after Covid-19. So far, Sacombank has transformed strongly and is accelerating back to track. It completes the Restructuring Project; effectively exploits Capital, increasing the efficiency of using Assets; expands business scale, increasing operational efficiency; enhances brand value, and develops customer trust; increases customer experience and satisfaction; improves management, improves operating methods; standardizes operations, and strengthens risk management; strengthens the foundation of Digital Transformation Strategy; optimizes human resource policies, promoting labor productivity; connects corporate culture to operating strategy.

To develop the customer segment in small and medium enterprises (SMEs), Sacombank increases engagement and takes advantage of opportunities to develop an existing large corporate customer base. To develop large corporate customer segments, Sacombank develops the orientation of risk management.

INSPIRATIONAL BRAND CATEGORY

Sai Gon Thuong Tin Commercial Joint Stock Bank (Sacombank)

Information about the Company & Brand

Sacombank is one of the first Joint Stock Commercial Banks established in Ho Chi Minh City with initial charter capital of VND3 billion. Throughout the pandemic, Sacombank has firmly applied its achievements, the quintessence of technology to flexibly implement many policies to fully ensure the interests of each shareholder, partner, customer, and investor, therefore reaching the milestone of serving up to 10 million customers row.

In 2022, Sacombank is confident to continue to maintain its position, keeping the trust of shareholders, partners, customers, and investors, and committed to writing more impressive numbers in the restructuring journey.

Brand Elements

Amid many difficulties caused by the Covid-19 pandemic, the 10 million customer expansion campaign launched by Sacombank at the beginning of 2021 has reached the finish line one month ahead of schedule.

Technology is the basis for Sacombank to launch a campaign of 10 million customers with 2 main spears – promotions and boosting total sales on channels, especially online channels.

The campaign was deployed wildly at all transaction points, promoting through online marketing channels, and spreading positive energy to the community in the form of posting and live streams.

Sacombank combined forces with large enterprises and prestigious economic organizations such as Vietnam Airlines, and Bamboo Airways, and connected with digital platforms such as Tiki, Zalo and a system of 2000 schools at all levels, and international remittance partners to create a financial ecosystem.

Sacombank constantly invested in payment services through online channels such as Internet Banking, Moblie Banking, and Sacombank Pay on a first-class, safe and secure technology platform.

Sacombank is one of the first Joint Stock Commercial Banks established in Ho Chi Minh City with initial charter capital of VND3 billion. Throughout the pandemic, Sacombank has firmly applied its achievements, the quintessence of technology to flexibly implement many policies to fully ensure the interests of each shareholder, partner, customer, and investor, therefore reaching the milestone of serving up to 10 million customers row.

In 2022, Sacombank is confident to continue to maintain its position, keeping the trust of shareholders, partners, customers, and investors, and committed to writing more impressive numbers in the restructuring journey.

Brand Elements

Amid many difficulties caused by the Covid-19 pandemic, the 10 million customer expansion campaign launched by Sacombank at the beginning of 2021 has reached the finish line one month ahead of schedule.

Technology is the basis for Sacombank to launch a campaign of 10 million customers with 2 main spears – promotions and boosting total sales on channels, especially online channels.

The campaign was deployed wildly at all transaction points, promoting through online marketing channels, and spreading positive energy to the community in the form of posting and live streams.

Sacombank combined forces with large enterprises and prestigious economic organizations such as Vietnam Airlines, and Bamboo Airways, and connected with digital platforms such as Tiki, Zalo and a system of 2000 schools at all levels, and international remittance partners to create a financial ecosystem.

Sacombank constantly invested in payment services through online channels such as Internet Banking, Moblie Banking, and Sacombank Pay on a first-class, safe and secure technology platform.

"Growing together": with shareholders to accompany the Bank, the Bank to accompany the customers, the Bank to accompany the society.

Inspiring Identity

With 30 years of establishment and development, Sacombank has always been consistent with its sustainable development-oriented governance model. This is a guideline to help the Bank firmly cope with difficulties and challenges to spread positive beliefs and values to the community and society.

In 2021, Sacombank continues to meet all the criteria in the Corporate Sustainability Index (CSI) and was honored as the Top 3 most favorite listed companies by investors in 2021 in the Program of Average Business. Selected Listed Company with Best Investor Relations in 2021 (IR Awards 2021) conducted by Vietstock in collaboration with Finance and Life newspaper (Fili.vn).

The foundation for its development lies in its wide customer base and the trust of nearly 200,000 corporate customers over the past 30 years. Sacombank has always understood and maintained its relationship with corporate customers by constantly improving and diversifying products and services to bring customers the most optimal experience.

Achievements & Impact

By the end of November 2021, the 10 million customer campaign has reached its target with a growth of 143% compared to 2020. With the pioneering factor in technology, Sacombank has continuously deployed large campaigns to attract clients. Typically, "Brilliant Summer Opening – Opening Million Deals" with 4 incentive programs, dialing, and millions of valuable prizes for all individual and corporate customers using services at the counters and transactions.

In the past two years, Sacombank's online transaction channels have proven their advantage in supporting customers to make transactions, helping to limit contact and save time and money.

Future Direction

Vietnam's economy and financial market are expected to receive both opportunities and challenges after Covid-19. So far, Sacombank has transformed strongly and is accelerating back to track. It completes the Restructuring Project; effectively exploits Capital, increasing the efficiency of using Assets; expands business scale, increasing operational efficiency; enhances brand value, and develops customer trust; increases customer experience and satisfaction; improves management, improves operating methods; standardizes operations, and strengthens risk management; strengthens the foundation of Digital Transformation Strategy; optimizes human resource policies, promoting labor productivity; connects corporate culture to operating strategy.

To develop the customer segment in small and medium enterprises (SMEs), Sacombank increases engagement and takes advantage of opportunities to develop an existing large corporate customer base. To develop large corporate customer segments, Sacombank develops the orientation of risk management.

With 30 years of establishment and development, Sacombank has always been consistent with its sustainable development-oriented governance model. This is a guideline to help the Bank firmly cope with difficulties and challenges to spread positive beliefs and values to the community and society.

In 2021, Sacombank continues to meet all the criteria in the Corporate Sustainability Index (CSI) and was honored as the Top 3 most favorite listed companies by investors in 2021 in the Program of Average Business. Selected Listed Company with Best Investor Relations in 2021 (IR Awards 2021) conducted by Vietstock in collaboration with Finance and Life newspaper (Fili.vn).

The foundation for its development lies in its wide customer base and the trust of nearly 200,000 corporate customers over the past 30 years. Sacombank has always understood and maintained its relationship with corporate customers by constantly improving and diversifying products and services to bring customers the most optimal experience.

Achievements & Impact

By the end of November 2021, the 10 million customer campaign has reached its target with a growth of 143% compared to 2020. With the pioneering factor in technology, Sacombank has continuously deployed large campaigns to attract clients. Typically, "Brilliant Summer Opening – Opening Million Deals" with 4 incentive programs, dialing, and millions of valuable prizes for all individual and corporate customers using services at the counters and transactions.

In the past two years, Sacombank's online transaction channels have proven their advantage in supporting customers to make transactions, helping to limit contact and save time and money.

Future Direction

Vietnam's economy and financial market are expected to receive both opportunities and challenges after Covid-19. So far, Sacombank has transformed strongly and is accelerating back to track. It completes the Restructuring Project; effectively exploits Capital, increasing the efficiency of using Assets; expands business scale, increasing operational efficiency; enhances brand value, and develops customer trust; increases customer experience and satisfaction; improves management, improves operating methods; standardizes operations, and strengthens risk management; strengthens the foundation of Digital Transformation Strategy; optimizes human resource policies, promoting labor productivity; connects corporate culture to operating strategy.

To develop the customer segment in small and medium enterprises (SMEs), Sacombank increases engagement and takes advantage of opportunities to develop an existing large corporate customer base. To develop large corporate customer segments, Sacombank develops the orientation of risk management.