MASTER ENTREPRENEUR CATEGORY

VITAI RATANAKORN

President & CEOGovernment Savings Bank

Financial Services Industry

www.gsb.or.th

Information about the Entrepreneur

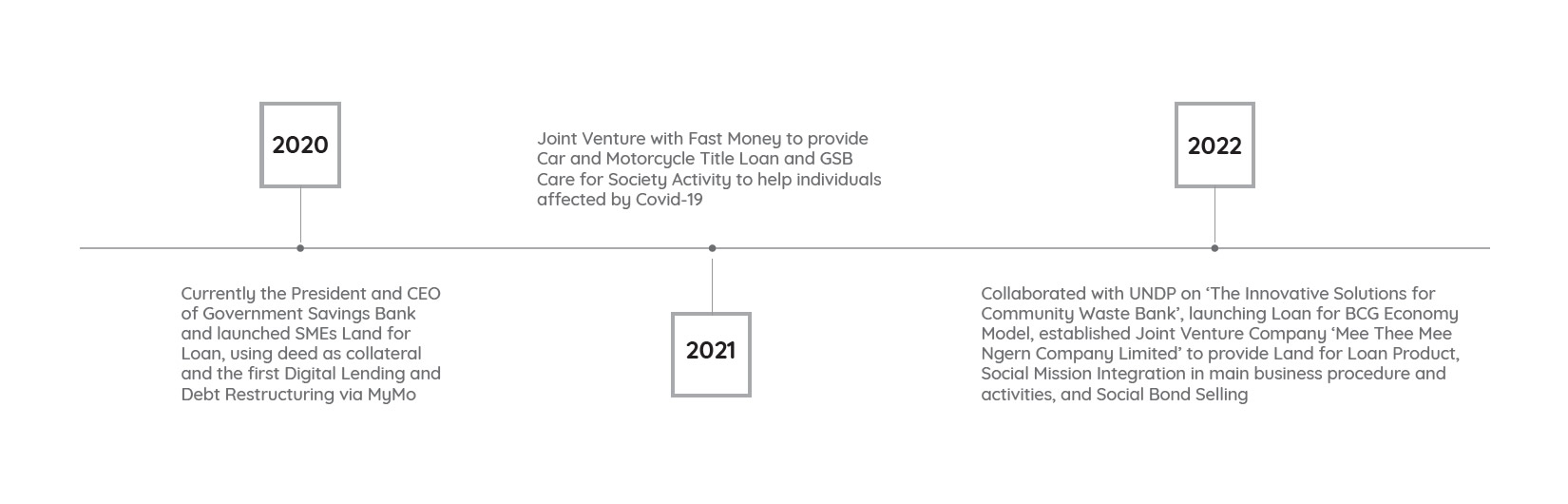

Vitai Ratanakorn is the President and CEO of Government Savings Bank (GSB) since July 2020. He graduated with a Bachelor of Economics from Thammasat University, Thailand; Master of Finance from Drexel University, United States of America; Master of Laws (Business Law), and Master of Arts (Political Economy) from Chulalongkorn University, Thailand.Vitai Ratanakorn is proficient in investment and financial management, with working experiences as the Secretary General of Government Pension Fund, Acting President of Islamic Bank of Thailand, Chief Financial Officer of Nok Airlines Public Company Limited, and Senior Deputy Managing Director of Charoen Pokphand Group Company Limited.

Other Interesting Facts about the Entrepreneur

The structural problems of Thai society are inequality and poverty. Government Savings Bank (GSB), in the position of SFIs, plays a role as a Social Bank operating under dual missions, which are social mission and commercial mission. GSB aims to bring the profit from commercial mission to subsidize social mission in order to reduce inequality and to provide financial inclusion for people. It is complying with the Sustainable Development Goals (SDGs) of the United Nations by focusing on 2 out of 17 SDGs, which are ‘No Poverty’ and ‘Reduced Inequalities’.GSB also pays attention to Social Mission Integration in its main business procedure and activities for sustainability and expects its result of ‘Making Positive Impact on Society’.

Helping people is not about our image or CSR Project, but helping people is our mission.

Company Achievements and

Role of the Entrepreneur

During the 2 years of the Covid-19 pandemic, GSB played a

significant role in helping those who were affected with over 13

million beneficiaries in both the business sector and public sector

through 47 government policy projects.

The projects include low-interest rate loans with flexible terms and conditions, financial inclusion, financial skills, and career development for entrepreneurs and community organizations to make a positive impact on society.

GSB has additionally developed a digital service channel, by first launching a digital lending service and debt restructuring program for retail customers via mobile banking (MyMo), to relieve payment installation and NPLs problems.

GSB is the second bank in Thailand that signed the Principles for Responsible Banking (PRB) of the United Nations Environment Programme Finance Initiative (UNEP FI) to step forward into Sustainable Banking.

GSB has also developed a new business model through a joint venture with non-bank in Car and Motorcycle Title Loans, aiming to reduce the interest in the market from 28% to 16-18% to help more than one million people in the country. Moreover, GSB helps SMEs that have no cash flow and liquidity but have their own land as collateral for SMEs loan with interest rates of over THB22,000 million, which is lower compared to the rest of the market.

Vision, Mission & Future Plans

Vitai Ratanakorn announced GSB’s vision to be a “Social Bank” by applying Social Mission Integration, ESGs, BCG Model, and Principles for Responsible Banking to the GSB context for making a positive impact on society, as well as being an innovation-driven organization.CAREER HIGHLIGHTS