Information about the Company

Government Housing Bank (G H Bank) is a solely state-owned and specialized financial institution under the supervision of the Ministry of Finance established under the Government Housing Bank Act B.E. 2496 to provide credit – Housing loan and deposit services. The Bank operates its business in accordance with Royal Decrees, Ministerial Regulations, and other related notifications issued by the Bank of Thailand, the Ministry of Finance, and related agencies.Under the G H Bank’s vision of “The Best Housing Solution Bank”, G H Bank is committed to upholding its mission of “Enabling More Thai People to have their own homes” and maintaining a leadership position in the housing loan market along with enhancing its customer services to accommodate customer behaviors in the New Normal era and to support its transition to a Digital Bank in the future by establishing strategic plans/projects that support being a Digital Bank.

Corporate Culture & Company Activities

G H Bank encouraged the organization’s culture through G H Bank’s core value of GIVE +4 and passion-building for its people. The GIVE+4 aims to help G H Bank’s people to manage emerging trends and changes. It comprises Good Governance, Innovative Thoughts, Value Teamwork, Excellent Services, (En)courage to Change, Achievement Oriented, Professional, and Speed.The Bank also focuses on developing individual capability in digital literacy to prepare and serve for the transformation to a digital banking strategic position. G H Bank encourages a work culture based on the organization’s core values through the 3 dimensions of awareness and acknowledgment, establishing the work environment that serves expected behavior, and stimulating and promoting the work culture to align with the core value.

The Bank also initiated a corporate activity to uplift its organizational culture which comprises symphony meetings, MC Weekly, Pee Sorn Nong, Show & Share, and meeting with the Bank’s President.

Good Result Come from Good Process.

With the belief of “Good Result comes from Good Process”, G H Bank prioritizes the process of management as the highest priority.

Achievements and Impact

With the belief of “Good Result comes from Good Process”, G H Bank prioritizes the process of management as the highest priority. This focus has continuously led the bank to perform an outstanding business output and outcome compared with the private sector and maintain its market-leading position for ten years in a row with a market share of 40.3% (2021).Moreover, the Bank achieved a new loan value of THB246,875 million and an outstanding loan value of THB1,458,659 million at the end of 2021, which is the highest in Thailand’s housing finance market. The Bank also managed a non-performing loan to have a value of THB 58,381 million, which is equal to 4% of the total loan value at the end of 2021.

In addition, a total of 22 G H Bank Covid-19 supporting programs were specifically established to serve each customer’s situation. The Bank also achieved a total Net Profit value of THB12,351 million, which was an 18.4% growth from 2020. G H Bank operated under the digital transaction of 62.04% compared with electronic machines and traditional transactions.

Future Direction

The Bank has established a strategic position as a goal to achieve its vision by setting goals into three phases: short-term goals of becoming a Digital Service Bank in 2021-2022, medium-term goals of becoming a Digital Bank in 2023, and long-term goals of becoming The Best Housing Bank in 2024-2025 by focusing on adjusting strategies to increase the capacity of digital services in terms of products, information technology system service, and personnel in response to the rapid change in technology and customer behavior.According to its mission of “Enabling More Thai People to have their own homes” and the main strategic positioning to become the best housing bank in Thailand before 2025, G H Bank’s future direction also aims to claim the title of “Sustainable Bank”. With those agendas, G H Bank has initiated strategic objectives aligned with sustainable dimensions to achieve the title of a leading sustainable bank in Thailand. In the short term, its key objective is to maximize “Financial Inclusion” which aims to “Create different Financial Aids” to support customers to achieve home aspirations and ensure that everyone can gain financial instruments for both saving and lending.

In the medium term, G H Bank attempts to “Minimize social inequality” by uplifting the operation process to enable customers access to the services. For its long-term objective, G H Bank aims to minimize poverty in all its forms everywhere in Thailand by equalizing people’s opportunities to own a house and truly enabling Thai people to have their own homes.

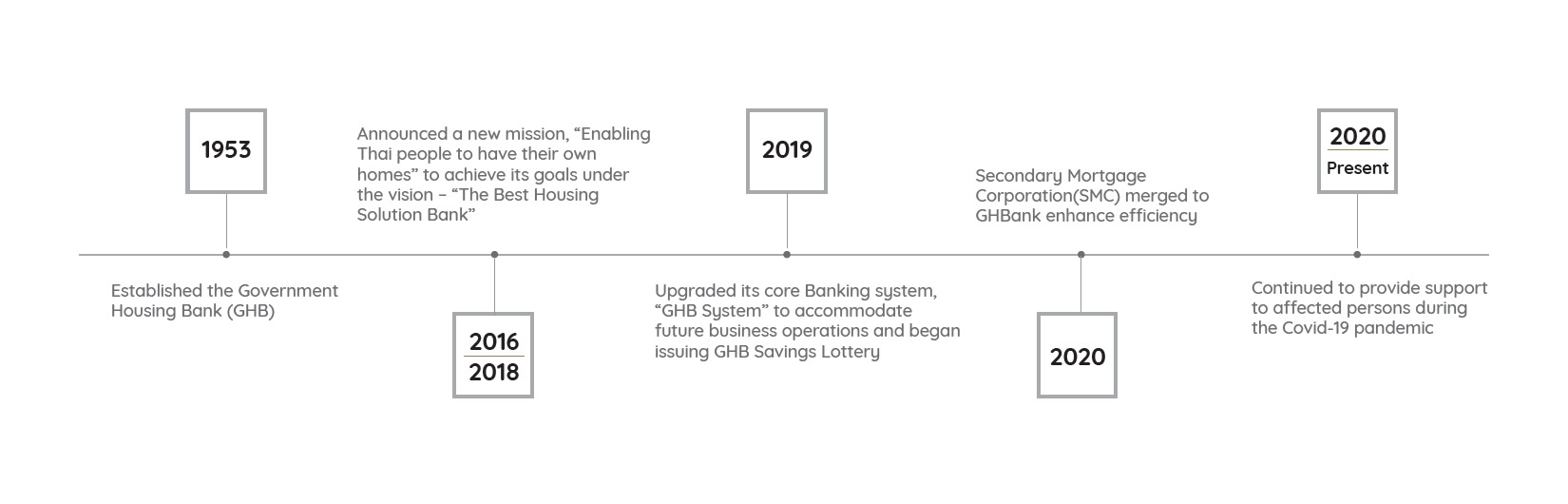

COMPANY MILESTONES