Douglas Tong Hsu is Chairman and CEO of Far Eastern Group (FEG), one of the largest and most diversified conglomerates based in Taiwan.

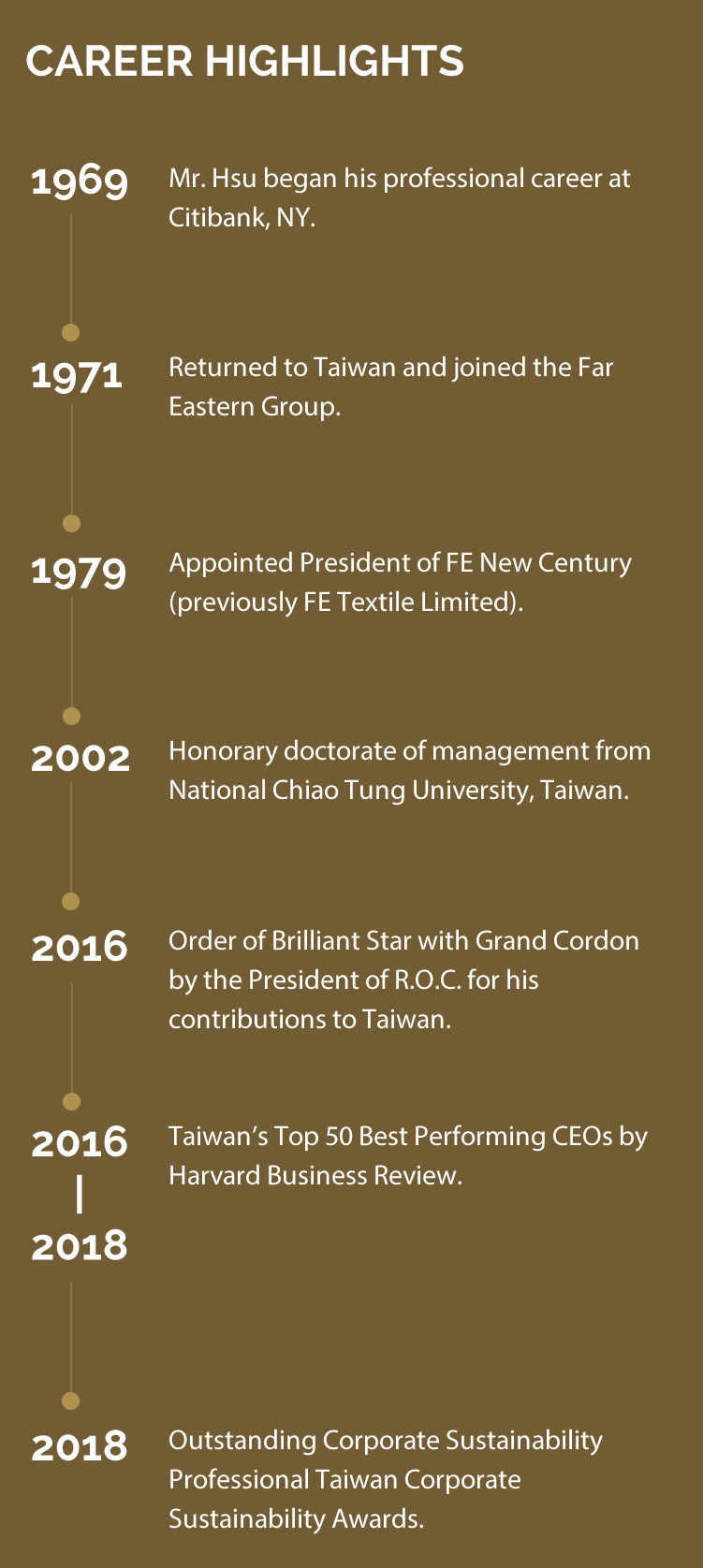

Mr. Hsu began his professional career at Citibank, NY, before returning to Taiwan and joining the Far Eastern Group in 1971. In 1979, he was appointed President of FETL (later renamed Far Eastern New Century), and was later appointed to Chairman of the Group. From the Group’s founding motto of “Sincerity, Diligence, Thrift and Prudence,” Mr. Hsu added one vital principle of “Innovation”. He leads the Group for further growth and development through continuous expansion, transformation and restructuring.

Mr. Hsu holds a B.A. and M.A. from the University of Notre Dame, Indiana, and pursued post-graduate economics at Columbia University. Mr. Hsu also holds an honorary doctorate of management from National Chiao Tung University, Taiwan awarded in 2002.

In 2016, Mr. Hsu was bestowed with the Order of Brilliant Star with Grand Cordon by the President for his contributions to Taiwan. Mr. Hsu was also listed as one of the Outstanding Corporate Sustainability Professionals in 2018 by Taiwan Corporate Sustainability Awards. He was named in Taiwan’s Top 50 Best Performing CEOs by Harvard Business Review in 2016 and 2018.

Committed to social responsibility, the Group’s multiple non-profit foundations established Taiwan’s leading technical institute, private university and hospital. Far Eastern Memorial Foundation, Far Eastern Medical Foundation, and Mr. Y. Z. Hsu Science & Technology Memorial Foundation have been dedicated to sponsor diverse cultural activities and medical research programmes. The Group also encourages innovative thinking in architecture and scientific research areas by nurturing young minds through its “Far Eastern

Architectural Award,” “Y. Z. Hsu Scientific Chair Professor,” and “Y. Z. Hsu Scientific Paper Award,”.

Mr. Hsu’s leadership positions outside FEG include MasterCard Asia/Pacific Regional Advisory Board (Board Director), Asia Business Council, Asian Cultural Council (Trustee, part of the Rockefeller Foundation), Asian Cultural Council Taiwan Foundation (Chairman),

Trustee of University of Notre Dame (Emeritus), National Cultural & Arts Foundation (Board Member), and Asian Cultural Council Taiwan Foundation (Chairman).

Across Asia, industrial conglomerates are shaping the competitive commercial landscape and driving the region’s economic growth. They have also been diversifying themselves at a phenomenal pace, by conducting new business sectors at an average rate of one acquisition every 18 months. The Far Eastern Group exemplifies this approach. Celebrating its 70th founding anniversary this year, its enterprises have expanded across 10 industries as the most diversified conglomerate in Taiwan.

It is a trend that runs contrary to those in the West, where these days the idea of branching out into a new sector where there are no discernible synergies is usually treated with scepticism. But in Asia the model works, and Taiwan’s Far Eastern Group (FEG) is a classic successful example of growth by acquisition.

With nine listed companies and 250 affiliates operating in 10 business sectors that spans from petrochemicals and building materials to retail, financial services and IT, FEG has come a very long way from a textile manufacturer 70 years ago. Its achievements since then have attracted more than 600,000 shareholders, with accumulated assets of $85 billion and annual revenues to over $24 billion.

“We have grown and prospered in tandem with Taiwan’s and China’s overall economy,” explains its Chairman Douglas Tong Hsu, whose father founded the group. “We are active in three basic areas which are petrochemicals and polyesters, cement and department stores. It is all very diverse which I find exciting. It keeps me active.”

“We have grown and prospered in tandem with Taiwan’s and China’s overall economy,” explains its Chairman Douglas Tong Hsu, whose father founded the group. “We are active in three basic areas which are petrochemicals and polyesters, cement and department stores. It is all very diverse which I find exciting. It keeps me active.”

With each business unit administered individually, a rapidly changing and increasingly digitalized environment is demanding more connectivity between the group’s constituent parts. “Each affiliate needs to be aligned with the group’s overall corporate governance requirements,” he says. “The companies we own can no longer operate as silo entities. The situation is going to get even more

complicated and challenging with the arrival of Artificial Intelligence (AI) and the Internet of Things (IoT).”

ICT is not the only part of the group that has recently been helping the company develop what Hsu calls its ’growthoriented model’ by any stretch of the imagination and FEG’s petrochemical and polyester division has been particularly active. Over the past 20 years it had steadily built up a network of production plants across Southeast Asia and mainland China. In 2015, it established a vertically integrated production site in Vietnam. Last year, the group entered into a joint venture to buy an unfinished PET resin and feedstocks plant in Texas for $1.125 billion. On completion, the plant will be the largest single-line vertically integrated PTA-PET production facility in the world, with FEG guaranteed purchasing of one-third share of its annual production capacity. FEG is also active in upward integration into raw material.

The acquisition of the Texan PET plant (along with two smaller, earlier US investments) marks a watershed for the group as it looks to expand into North America. “Our development model proves that we are adaptive to change and have already become a global player.” Mr. Hsu says.

SPECIAL ACHIEVEMENT AWARD

Mr. Douglas Tong Hsu

Chairman & CEO

Douglas Tong Hsu is Chairman and CEO of Far Eastern Group (FEG), one of the largest and most diversified conglomerates based in Taiwan.

Mr. Hsu began his professional career at Citibank, NY, before returning to Taiwan and joining the Far Eastern Group in 1971. In 1979, he was appointed President of FETL (later renamed Far Eastern New Century), and was later appointed to Chairman of the Group. From the Group’s founding motto of “Sincerity, Diligence, Thrift and Prudence,” Mr. Hsu added one vital principle of “Innovation”. He leads the Group for further growth and development through continuous expansion, transformation and restructuring.

Mr. Hsu holds a B.A. and M.A. from the University of Notre Dame, Indiana, and pursued post-graduate economics at Columbia University. Mr. Hsu also holds an honorary doctorate of management from National Chiao Tung University, Taiwan awarded in 2002.

In 2016, Mr. Hsu was bestowed with the Order of Brilliant Star with Grand Cordon by the President for his contributions to Taiwan. Mr. Hsu was also listed as one of the Outstanding Corporate Sustainability Professionals in 2018 by Taiwan Corporate Sustainability Awards. He was named in Taiwan’s Top 50 Best Performing CEOs by Harvard Business Review in 2016 and 2018.

Committed to social responsibility, the Group’s multiple non-profit foundations established Taiwan’s leading technical institute, private university and hospital. Far Eastern Memorial Foundation, Far Eastern Medical Foundation, and Mr. Y. Z. Hsu Science & Technology Memorial Foundation have been dedicated to sponsor diverse cultural activities and medical research programmes. The Group also encourages innovative thinking in architecture and scientific research areas by nurturing young minds through its “Far Eastern

Architectural Award,” “Y. Z. Hsu Scientific Chair Professor,” and “Y. Z. Hsu Scientific Paper Award,”.

Mr. Hsu’s leadership positions outside FEG include MasterCard Asia/Pacific Regional Advisory Board (Board Director), Asia Business Council, Asian Cultural Council (Trustee, part of the Rockefeller Foundation), Asian Cultural Council Taiwan Foundation (Chairman),

Trustee of University of Notre Dame (Emeritus), National Cultural & Arts Foundation (Board Member), and Asian Cultural Council Taiwan Foundation (Chairman).

“We have grown and prospered in tandem with Taiwan’s and China’s overall economy,” explains its Chairman Douglas Tong Hsu, whose father founded the group. “We are active in three basic areas which are petrochemicals and polyesters, cement and department stores. It is all very diverse which I find exciting. It keeps me active.”

Across Asia, industrial conglomerates are shaping the competitive commercial landscape and driving the region’s economic growth. They have also been diversifying themselves at a phenomenal pace, by conducting new business sectors at an average rate of one acquisition every 18 months. The Far Eastern Group exemplifies this approach. Celebrating its 70th founding anniversary this year, its enterprises have expanded across 10 industries as the most diversified conglomerate in Taiwan.

It is a trend that runs contrary to those in the West, where these days the idea of branching out into a new sector where there are no discernible synergies is usually treated with scepticism. But in Asia the model works, and Taiwan’s Far Eastern Group (FEG) is a classic successful example of growth by acquisition.

With nine listed companies and 250 affiliates operating in 10 business sectors that spans from petrochemicals and building materials to retail, financial services and IT, FEG has come a very long way from a textile manufacturer 70 years ago. Its achievements since then have attracted more than 600,000 shareholders, with accumulated assets of $85 billion and annual revenues to over $24 billion.

“We have grown and prospered in tandem with Taiwan’s and China’s overall economy,” explains its Chairman Douglas Tong Hsu, whose father founded the group. “We are active in three basic areas which are petrochemicals and polyesters, cement and department stores. It is all very diverse which I find exciting. It keeps me active.”

With each business unit administered individually, a rapidly changing and increasingly digitalized environment is demanding more connectivity between the group’s constituent parts. “Each affiliate needs to be aligned with the group’s overall corporate governance requirements,” he says. “The companies we own can no longer operate as silo entities. The situation is going to get even more

complicated and challenging with the arrival of Artificial Intelligence (AI) and the Internet of Things (IoT).”

ICT is not the only part of the group that has recently been helping the company develop what Hsu calls its ’growthoriented model’ by any stretch of the imagination and FEG’s petrochemical and polyester division has been particularly active. Over the past 20 years it had steadily built up a network of production plants across Southeast Asia and mainland China. In 2015, it established a vertically integrated production site in Vietnam. Last year, the group entered into a joint venture to buy an unfinished PET resin and feedstocks plant in Texas for $1.125 billion. On completion, the plant will be the largest single-line vertically integrated PTA-PET production facility in the world, with FEG guaranteed purchasing of one-third share of its annual production capacity. FEG is also active in upward integration into raw material.

The acquisition of the Texan PET plant (along with two smaller, earlier US investments) marks a watershed for the group as it looks to expand into North America. “Our development model proves that we are adaptive to change and have already become a global player.” Mr. Hsu says.