Information about the Company & Brand

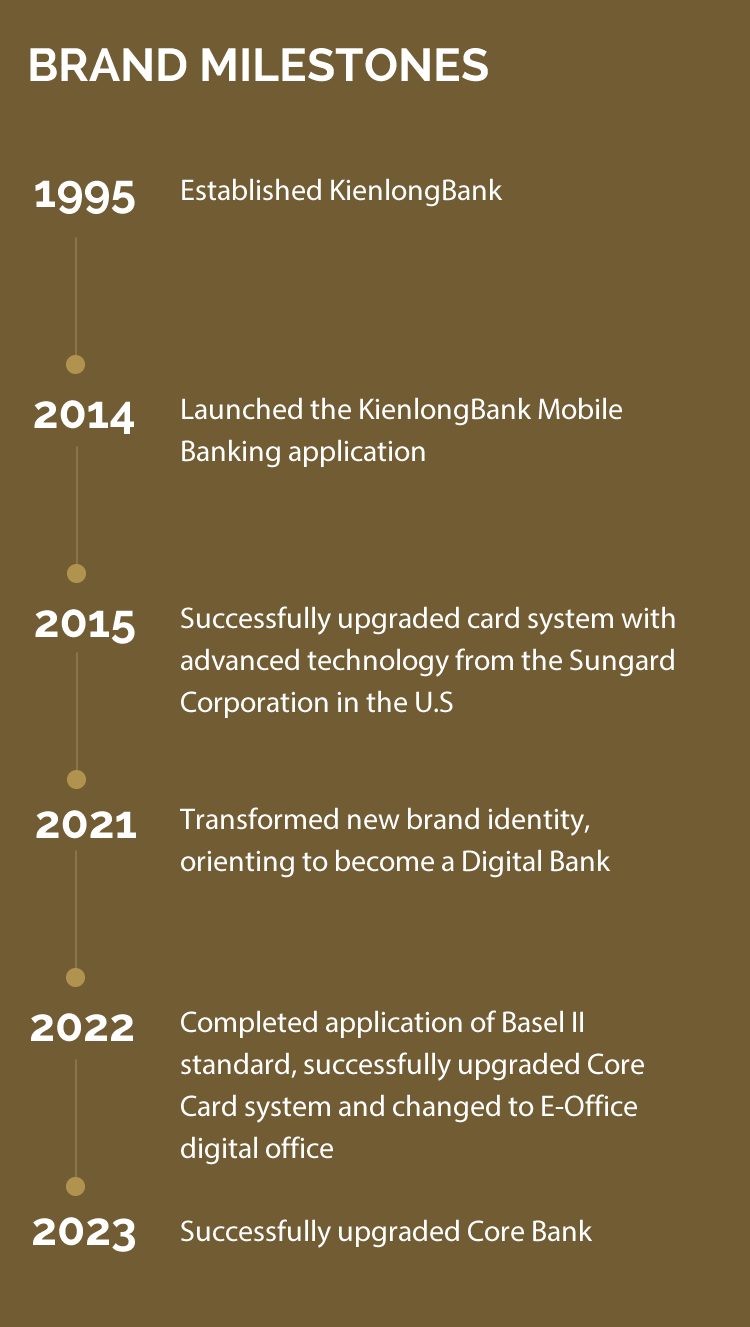

Kien Long Commercial Joint - Stock Bank (KienlongBank), founded in the province of Kien Giang in 1995, has been continuously innovating to keep up with the growth of the nation's economy in the 4.0 era. KienlongBank has been continuously researching and launching a variety of products and services to offer a completely personalized experience, with the goal of becoming a contemporary and all-encompassing "Digital Bank" in Vietnam. KienlongBank defines digital transformation as a strategic direction for effective competition and sustainable development in the new era.

Brand Elements

As one of the banks with the greatest potential, KienlongBank is resolved to lead the way in technological advancement, seize the "golden keys" to keep up with the new era, and realize its goal of becoming the top digital bank in Vietnam by 2025 as it enters its 28th year. In this technology-based digital transformation strategy, KienlongBank will optimize its organizational structure in the direction of centralization, consider customers when developing all products and services, create a suitable sales channel model, and put special emphasis on developing and raising the caliber of its "digital human resources" team.

With a rich history and steadfast efforts, KienlongBank has been consistently enhancing and diversifying its services, professionalizing each endeavor, and greatly enhancing the bank's operational effectiveness. As of right now, KienlongBank is one of the best commercial banks in the country with a network of branches and transaction offices that are spread over many provinces and towns. It is a dependable partner for a wide range of clients, companies, and international and domestic economic organizations. The company now has a stake over time in Vietnam's joint stock commercial banking system.

Inspiring Identity

To use information technology (IT) to advance banking services and products, banks in Vietnam now face various challenges regarding their digital platform, technical infrastructure, and transaction security. This is because the majority of banks that wish to use technology for digital transformation still have to import their hardware and software.

In response, KienlongBank has outlined a methodical and extensive development roadmap for the bank to revolutionize a change in both its quality and quantity. These changes range from operation models, services, equipment, facilities, and technology platforms to human resources in order to become a specialized and comprehensive new-generation digital bank that meets international standards.

KienlongBank also decided to work with domestic partners to conduct research and develop key technology in the area of banking and finance. This deed demonstrates KienlongBank's resolve and supports its position of pushing "Made in Vietnam" goods.

Kien Long Commercial Joint - Stock Bank (KienlongBank), founded in the province of Kien Giang in 1995, has been continuously innovating to keep up with the growth of the nation's economy in the 4.0 era. KienlongBank has been continuously researching and launching a variety of products and services to offer a completely personalized experience, with the goal of becoming a contemporary and all-encompassing "Digital Bank" in Vietnam. KienlongBank defines digital transformation as a strategic direction for effective competition and sustainable development in the new era.

Brand Elements

As one of the banks with the greatest potential, KienlongBank is resolved to lead the way in technological advancement, seize the "golden keys" to keep up with the new era, and realize its goal of becoming the top digital bank in Vietnam by 2025 as it enters its 28th year. In this technology-based digital transformation strategy, KienlongBank will optimize its organizational structure in the direction of centralization, consider customers when developing all products and services, create a suitable sales channel model, and put special emphasis on developing and raising the caliber of its "digital human resources" team.

With a rich history and steadfast efforts, KienlongBank has been consistently enhancing and diversifying its services, professionalizing each endeavor, and greatly enhancing the bank's operational effectiveness. As of right now, KienlongBank is one of the best commercial banks in the country with a network of branches and transaction offices that are spread over many provinces and towns. It is a dependable partner for a wide range of clients, companies, and international and domestic economic organizations. The company now has a stake over time in Vietnam's joint stock commercial banking system.

Inspiring Identity

To use information technology (IT) to advance banking services and products, banks in Vietnam now face various challenges regarding their digital platform, technical infrastructure, and transaction security. This is because the majority of banks that wish to use technology for digital transformation still have to import their hardware and software.

In response, KienlongBank has outlined a methodical and extensive development roadmap for the bank to revolutionize a change in both its quality and quantity. These changes range from operation models, services, equipment, facilities, and technology platforms to human resources in order to become a specialized and comprehensive new-generation digital bank that meets international standards.

KienlongBank also decided to work with domestic partners to conduct research and develop key technology in the area of banking and finance. This deed demonstrates KienlongBank's resolve and supports its position of pushing "Made in Vietnam" goods.

Change Up To 4.0 Digi-Era

Achievements & Impact

Digital transformation is recognized as a strategic solution to help the banking industry overcome the obstacles of the digital era and maximize the successes in the Industry 4.0 era with client-focused perspectives. To achieve this goal, KienlongBank has encouraged collaboration with domestic businesses to research and develop fundamental banking and finance technologies, boosting competitive advantages and improving end-user experience.

The first achievement in the development process of core technologies of KienlongBank and partners is the new generation banking transaction machine system, STM (Smart Teller Machine). The main focus that makes STM stand out is that it has UniCat core software. This automatic trading software on STM has been EMVCo Level 2 certified by EMVCo after passing all 852 meticulous and rigorous tests.

Along with being ranked in lists that recognize the company’s growth and profits, KienlongBank was named one of the Top 100 largest public firms in Vietnam by Forbes Vietnam in 2019. KienlongBank was also recognized as a "Typical Bank for the Community" in addition to its contributions to the expansion and advancement of the finance-banking sector.

Future Direction

KienlongBank is currently focused on investing in four development pillars to be expanded on in depth and quality: Customers, Technology & Digital Banking, Human Resources & Corporate Culture, And Partners. This is done in order to realize the company’s objective of becoming a modern and comprehensive digital bank.

Customers will be the focal point of all KienlongBank activities, serving as the cornerstone for enduring connections and values. Besides that, as a leader in the use of contemporary technology, KienlongBank will be migrating all of its banking services to digital platforms and implementing an open technology architecture.

Alongside these advancements, KienlongBank will develop a team of high-quality, qualified, dedicated human resources personnel for customers. The team will be focused on striving for the common development goal and consolidating corporate culture as a foundation to strengthen the connection between staff and customers. In particular, KienlongBank will develop a diversified network of partners on the basis of effective, creative, and win-win ideals, building an ecosystem of financial and non-financial services that provide All-in-One solutions for all customer demands.

KienlongBank encourages collaboration with both domestic and international partners in order to transform its core system in terms of technology and the growth of digital banks. In fact, the KienlongBank Plus Mobile Banking application, STM, and other goods and services will be further developed from these collaborations in order to enhance the end-user experience. At the same time, KienlongBank has been bringing the STM system to all 50 states and increasing the network of its All-in-One transaction offices.

Digital transformation is recognized as a strategic solution to help the banking industry overcome the obstacles of the digital era and maximize the successes in the Industry 4.0 era with client-focused perspectives. To achieve this goal, KienlongBank has encouraged collaboration with domestic businesses to research and develop fundamental banking and finance technologies, boosting competitive advantages and improving end-user experience.

The first achievement in the development process of core technologies of KienlongBank and partners is the new generation banking transaction machine system, STM (Smart Teller Machine). The main focus that makes STM stand out is that it has UniCat core software. This automatic trading software on STM has been EMVCo Level 2 certified by EMVCo after passing all 852 meticulous and rigorous tests.

Along with being ranked in lists that recognize the company’s growth and profits, KienlongBank was named one of the Top 100 largest public firms in Vietnam by Forbes Vietnam in 2019. KienlongBank was also recognized as a "Typical Bank for the Community" in addition to its contributions to the expansion and advancement of the finance-banking sector.

Future Direction

KienlongBank is currently focused on investing in four development pillars to be expanded on in depth and quality: Customers, Technology & Digital Banking, Human Resources & Corporate Culture, And Partners. This is done in order to realize the company’s objective of becoming a modern and comprehensive digital bank.

Customers will be the focal point of all KienlongBank activities, serving as the cornerstone for enduring connections and values. Besides that, as a leader in the use of contemporary technology, KienlongBank will be migrating all of its banking services to digital platforms and implementing an open technology architecture.

Alongside these advancements, KienlongBank will develop a team of high-quality, qualified, dedicated human resources personnel for customers. The team will be focused on striving for the common development goal and consolidating corporate culture as a foundation to strengthen the connection between staff and customers. In particular, KienlongBank will develop a diversified network of partners on the basis of effective, creative, and win-win ideals, building an ecosystem of financial and non-financial services that provide All-in-One solutions for all customer demands.

KienlongBank encourages collaboration with both domestic and international partners in order to transform its core system in terms of technology and the growth of digital banks. In fact, the KienlongBank Plus Mobile Banking application, STM, and other goods and services will be further developed from these collaborations in order to enhance the end-user experience. At the same time, KienlongBank has been bringing the STM system to all 50 states and increasing the network of its All-in-One transaction offices.

INSPIRATIONAL BRAND CATEGORY

KIEN LONG COMMERCIAL JOINT - STOCK BANK

Information about the Company & Brand

Kien Long Commercial Joint - Stock Bank (KienlongBank), founded in the province of Kien Giang in 1995, has been continuously innovating to keep up with the growth of the nation's economy in the 4.0 era. KienlongBank has been continuously researching and launching a variety of products and services to offer a completely personalized experience, with the goal of becoming a contemporary and all-encompassing "Digital Bank" in Vietnam. KienlongBank defines digital transformation as a strategic direction for effective competition and sustainable development in the new era.

Brand Elements

As one of the banks with the greatest potential, KienlongBank is resolved to lead the way in technological advancement, seize the "golden keys" to keep up with the new era, and realize its goal of becoming the top digital bank in Vietnam by 2025 as it enters its 28th year. In this technology-based digital transformation strategy, KienlongBank will optimize its organizational structure in the direction of centralization, consider customers when developing all products and services, create a suitable sales channel model, and put special emphasis on developing and raising the caliber of its "digital human resources" team.

With a rich history and steadfast efforts, KienlongBank has been consistently enhancing and diversifying its services, professionalizing each endeavor, and greatly enhancing the bank's operational effectiveness. As of right now, KienlongBank is one of the best commercial banks in the country with a network of branches and transaction offices that are spread over many provinces and towns. It is a dependable partner for a wide range of clients, companies, and international and domestic economic organizations. The company now has a stake over time in Vietnam's joint stock commercial banking system.

Inspiring Identity

To use information technology (IT) to advance banking services and products, banks in Vietnam now face various challenges regarding their digital platform, technical infrastructure, and transaction security. This is because the majority of banks that wish to use technology for digital transformation still have to import their hardware and software.

In response, KienlongBank has outlined a methodical and extensive development roadmap for the bank to revolutionize a change in both its quality and quantity. These changes range from operation models, services, equipment, facilities, and technology platforms to human resources in order to become a specialized and comprehensive new-generation digital bank that meets international standards.

KienlongBank also decided to work with domestic partners to conduct research and develop key technology in the area of banking and finance. This deed demonstrates KienlongBank's resolve and supports its position of pushing "Made in Vietnam" goods.

Kien Long Commercial Joint - Stock Bank (KienlongBank), founded in the province of Kien Giang in 1995, has been continuously innovating to keep up with the growth of the nation's economy in the 4.0 era. KienlongBank has been continuously researching and launching a variety of products and services to offer a completely personalized experience, with the goal of becoming a contemporary and all-encompassing "Digital Bank" in Vietnam. KienlongBank defines digital transformation as a strategic direction for effective competition and sustainable development in the new era.

Brand Elements

As one of the banks with the greatest potential, KienlongBank is resolved to lead the way in technological advancement, seize the "golden keys" to keep up with the new era, and realize its goal of becoming the top digital bank in Vietnam by 2025 as it enters its 28th year. In this technology-based digital transformation strategy, KienlongBank will optimize its organizational structure in the direction of centralization, consider customers when developing all products and services, create a suitable sales channel model, and put special emphasis on developing and raising the caliber of its "digital human resources" team.

With a rich history and steadfast efforts, KienlongBank has been consistently enhancing and diversifying its services, professionalizing each endeavor, and greatly enhancing the bank's operational effectiveness. As of right now, KienlongBank is one of the best commercial banks in the country with a network of branches and transaction offices that are spread over many provinces and towns. It is a dependable partner for a wide range of clients, companies, and international and domestic economic organizations. The company now has a stake over time in Vietnam's joint stock commercial banking system.

Inspiring Identity

To use information technology (IT) to advance banking services and products, banks in Vietnam now face various challenges regarding their digital platform, technical infrastructure, and transaction security. This is because the majority of banks that wish to use technology for digital transformation still have to import their hardware and software.

In response, KienlongBank has outlined a methodical and extensive development roadmap for the bank to revolutionize a change in both its quality and quantity. These changes range from operation models, services, equipment, facilities, and technology platforms to human resources in order to become a specialized and comprehensive new-generation digital bank that meets international standards.

KienlongBank also decided to work with domestic partners to conduct research and develop key technology in the area of banking and finance. This deed demonstrates KienlongBank's resolve and supports its position of pushing "Made in Vietnam" goods.

Change Up To 4.0 Digi-Era

Achievements & Impact

Digital transformation is recognized as a strategic solution to help the banking industry overcome the obstacles of the digital era and maximize the successes in the Industry 4.0 era with client-focused perspectives. To achieve this goal, KienlongBank has encouraged collaboration with domestic businesses to research and develop fundamental banking and finance technologies, boosting competitive advantages and improving end-user experience.

The first achievement in the development process of core technologies of KienlongBank and partners is the new generation banking transaction machine system, STM (Smart Teller Machine). The main focus that makes STM stand out is that it has UniCat core software. This automatic trading software on STM has been EMVCo Level 2 certified by EMVCo after passing all 852 meticulous and rigorous tests.

Along with being ranked in lists that recognize the company’s growth and profits, KienlongBank was named one of the Top 100 largest public firms in Vietnam by Forbes Vietnam in 2019. KienlongBank was also recognized as a "Typical Bank for the Community" in addition to its contributions to the expansion and advancement of the finance-banking sector.

Future Direction

KienlongBank is currently focused on investing in four development pillars to be expanded on in depth and quality: Customers, Technology & Digital Banking, Human Resources & Corporate Culture, And Partners. This is done in order to realize the company’s objective of becoming a modern and comprehensive digital bank.

Customers will be the focal point of all KienlongBank activities, serving as the cornerstone for enduring connections and values. Besides that, as a leader in the use of contemporary technology, KienlongBank will be migrating all of its banking services to digital platforms and implementing an open technology architecture.

Alongside these advancements, KienlongBank will develop a team of high-quality, qualified, dedicated human resources personnel for customers. The team will be focused on striving for the common development goal and consolidating corporate culture as a foundation to strengthen the connection between staff and customers. In particular, KienlongBank will develop a diversified network of partners on the basis of effective, creative, and win-win ideals, building an ecosystem of financial and non-financial services that provide All-in-One solutions for all customer demands.

KienlongBank encourages collaboration with both domestic and international partners in order to transform its core system in terms of technology and the growth of digital banks. In fact, the KienlongBank Plus Mobile Banking application, STM, and other goods and services will be further developed from these collaborations in order to enhance the end-user experience. At the same time, KienlongBank has been bringing the STM system to all 50 states and increasing the network of its All-in-One transaction offices.

Digital transformation is recognized as a strategic solution to help the banking industry overcome the obstacles of the digital era and maximize the successes in the Industry 4.0 era with client-focused perspectives. To achieve this goal, KienlongBank has encouraged collaboration with domestic businesses to research and develop fundamental banking and finance technologies, boosting competitive advantages and improving end-user experience.

The first achievement in the development process of core technologies of KienlongBank and partners is the new generation banking transaction machine system, STM (Smart Teller Machine). The main focus that makes STM stand out is that it has UniCat core software. This automatic trading software on STM has been EMVCo Level 2 certified by EMVCo after passing all 852 meticulous and rigorous tests.

Along with being ranked in lists that recognize the company’s growth and profits, KienlongBank was named one of the Top 100 largest public firms in Vietnam by Forbes Vietnam in 2019. KienlongBank was also recognized as a "Typical Bank for the Community" in addition to its contributions to the expansion and advancement of the finance-banking sector.

Future Direction

KienlongBank is currently focused on investing in four development pillars to be expanded on in depth and quality: Customers, Technology & Digital Banking, Human Resources & Corporate Culture, And Partners. This is done in order to realize the company’s objective of becoming a modern and comprehensive digital bank.

Customers will be the focal point of all KienlongBank activities, serving as the cornerstone for enduring connections and values. Besides that, as a leader in the use of contemporary technology, KienlongBank will be migrating all of its banking services to digital platforms and implementing an open technology architecture.

Alongside these advancements, KienlongBank will develop a team of high-quality, qualified, dedicated human resources personnel for customers. The team will be focused on striving for the common development goal and consolidating corporate culture as a foundation to strengthen the connection between staff and customers. In particular, KienlongBank will develop a diversified network of partners on the basis of effective, creative, and win-win ideals, building an ecosystem of financial and non-financial services that provide All-in-One solutions for all customer demands.

KienlongBank encourages collaboration with both domestic and international partners in order to transform its core system in terms of technology and the growth of digital banks. In fact, the KienlongBank Plus Mobile Banking application, STM, and other goods and services will be further developed from these collaborations in order to enhance the end-user experience. At the same time, KienlongBank has been bringing the STM system to all 50 states and increasing the network of its All-in-One transaction offices.